Introduction: The Rise of AI-Driven Money Management

Managing personal finances has never been more important than in 2025. With inflation, shifting interest rates, and the ever-changing world of investments, people are increasingly turning to apps that help them save, invest, and budget smarter. What sets 2025 apart is the integration of artificial intelligence, automation, and predictive analytics into personal finance apps.

Today’s budgeting apps go beyond simple expense tracking. They forecast cash flow, recommend investment strategies, and even adjust financial goals dynamically. This article highlights the Top 10 finance and budgeting apps in 2025, showcasing how each one helps users make better financial decisions.

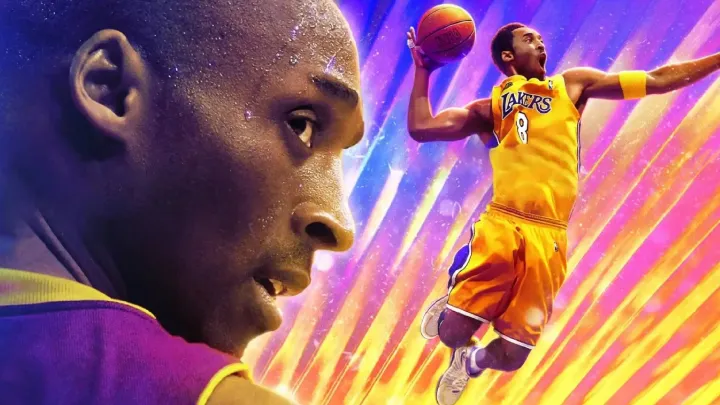

1. Mint 2.0: The Classic Gets Smarter

Mint has been a household name in budgeting for over a decade, and in 2025 it has transformed into Mint 2.0 with AI-powered insights.

Instead of simply categorizing expenses, Mint now uses predictive algorithms to forecast monthly cash flow and warn users about potential overspending before it happens. Its integration with banks worldwide has expanded, making it a truly global financial tool.

Another standout feature in 2025 is its subscription manager. Mint not only tracks recurring payments but also suggests cheaper alternatives, saving users money automatically.

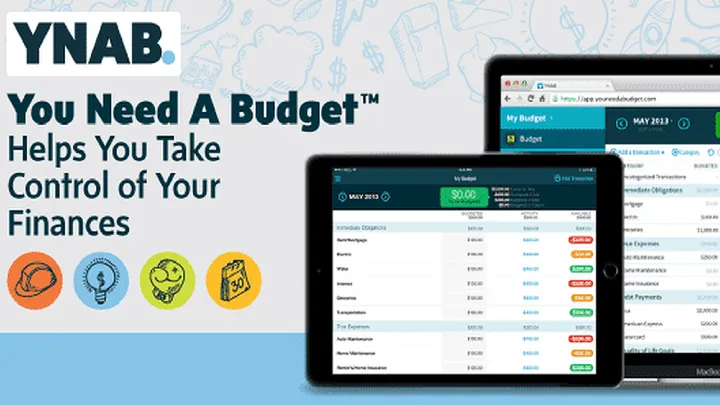

2. YNAB (You Need A Budget): Goal-Oriented Money Mastery

YNAB continues to thrive with its zero-based budgeting philosophy, teaching users to “give every dollar a job.” In 2025, the app has expanded to integrate AI-driven coaching.

Users now receive personalized suggestions based on past financial behavior. For example, if YNAB detects that you consistently overspend on dining out, it will suggest a practical adjustment plan without being intrusive.

The app has also improved its debt payoff visualization tools, helping users stay motivated while tracking progress toward becoming debt-free.

3. PocketGuard Plus: Simplified Money for Busy Lifestyles

PocketGuard is perfect for users who want simplicity. Its strength in 2025 lies in its “In My Pocket” feature, which calculates exactly how much disposable income you have after accounting for bills, savings goals, and recurring expenses.

The 2025 version introduces AI-powered bill negotiation. The app can now connect with service providers to lower internet, insurance, or phone bills automatically—turning budgeting into real savings.

Its clean, user-friendly interface makes PocketGuard an excellent option for beginners who don’t want to be overwhelmed by complex charts.

4. Goodbudget: Digital Envelope Budgeting Reimagined

Goodbudget brings the classic envelope budgeting system into the digital age. In 2025, it continues to focus on family and couple budgeting.

The app allows multiple users to share budgets, making it easier for couples or roommates to stay aligned financially. Its 2025 upgrade includes goal-based envelopes, where funds are automatically adjusted across categories to ensure long-term savings success.

Goodbudget also syncs in real time across devices, ensuring that everyone in a household knows the current financial status at all times.

5. Empower: Tracking Wealth and Investments Together

Formerly known as Personal Capital, Empower has evolved into a full-service financial management app. By 2025, it seamlessly combines budgeting, wealth tracking, and retirement planning.

Its standout feature is the AI-based investment advisor, which analyzes your spending and investment habits, then suggests portfolio adjustments in real time. Users also benefit from its robust retirement simulator, projecting various scenarios to help plan for long-term goals.

Empower is particularly well-suited for users who want to manage both day-to-day finances and larger wealth strategies in one place.

6. Monarch Money: The Rising Star of 2025

Monarch Money has quickly gained popularity with its sleek design and collaborative budgeting tools. In 2025, it stands out as a family-focused financial hub.

Its AI-powered scenario planning helps households simulate financial futures based on choices such as moving, changing jobs, or adjusting savings rates. Monarch also allows joint budgeting for couples, ensuring financial transparency and shared accountability.

The app’s subscription tracking and net worth visualization dashboards make it ideal for those who want both simplicity and depth in money management.

7. WallyGPT: AI Chat-Based Budgeting

Wally, known for its detailed expense tracking, has transformed in 2025 with WallyGPT, an AI assistant that functions like a financial coach.

Users can ask questions like, “How much can I safely spend on travel this month?” or “What happens if I increase my savings rate by 5%?” WallyGPT responds with personalized insights backed by real-time data.

This conversational budgeting style has made Wally a favorite for younger generations who prefer chat-based interfaces over traditional graphs.

8. Simplifi by Quicken: Everyday Money Simplified

Quicken’s Simplifi has become one of the most reliable apps for managing daily finances. In 2025, it introduces enhanced automation that tracks spending patterns and creates weekly spending reports tailored to each user’s habits.

Simplifi also offers goal-based savings buckets, making it easy to save for multiple purposes simultaneously, such as vacations, emergency funds, and debt repayment.

Its integration with investment accounts and real-time bank syncing makes it an all-in-one platform for users seeking simplicity without sacrificing detail.

9. Zeta: The Couple and Family Budgeting App

Zeta specializes in shared financial management, making it the go-to app for couples and families in 2025.

It allows couples to manage joint and individual accounts, set shared goals, and automate bill splitting. The app has enhanced its relationship-based insights, offering guidance for couples on how to align financial priorities and avoid conflicts.

In 2025, Zeta also integrates child savings accounts, helping parents instill financial literacy early by setting up goals and allowances for kids.

10. Spendee: Customizable Budgeting for Global Users

Spendee has become a global favorite thanks to its multi-currency support and visually engaging interface.

In 2025, Spendee introduces community budgets, allowing groups like friends traveling together to track expenses collectively. Its vibrant charts and graphs make it easy to understand financial health at a glance.

Spendee also offers integration with digital wallets and crypto accounts, reflecting the growing need to manage traditional and digital assets in one place.

Conclusion: Choosing the Right App for 2025

The top 10 finance and budgeting apps in 2025—Mint, YNAB, PocketGuard, Goodbudget, Empower, Monarch, WallyGPT, Simplifi, Zeta, and Spendee—showcase how far financial technology has come. These apps are no longer just about tracking expenses; they are intelligent money partners capable of forecasting, coaching, and automating financial growth.

Choosing the right app depends on your lifestyle:

- Beginners may prefer PocketGuard or Goodbudget.

- Couples and families benefit most from Zeta or Monarch.

- Investors and long-term planners should lean toward Empower or Mint 2.0.

- AI enthusiasts may find WallyGPT’s chat-based guidance revolutionary.

In 2025, managing money is less about spreadsheets and more about intelligent, real-time decision-making. With these tools, anyone can take control of their financial future.